David Carr, PhD – Senior Director, International Access Strategy, Precision AQ

Alex Grosvenor – Senior Vice President & Managing Director, International Access Strategy, Precision AQ

Public healthcare systems behave differently to many other industries in that the end-customer (the patient) is removed from the selection of the product (by the physician) and the buying process (from the NHS). And there’s an old analogy that goes something like this: One of us (David) goes out for dinner with two friends (let’s call them Neil and Oli). Kindly, Neil orders for me and Oli pays. Wonderful! But there’s an added nuance. Even if I look at the bill, I have no idea of what Oli actually paid – the ‘list price’ is right there, but he could have negotiated a deal with the restaurant to get a discount, and the ‘net price’ remains opaque to me.

In many markets this net price confidentiality is a prized component of the system, and its proponents argue that it is a necessary tool that on the health systems’ side enables value for money procurement, while on the manufacturers’ side protects their list products’ prices and reduces the impact of international price referencing, among other advantages for both. It also enables flexibility of pricing to reflect the different willingness to pay and affordability of individual countries.

What’s the consensus? There is no consensus.

There are calls to end the practice of confidentiality, with the strongest voice coming from the World Health Organization (WHO), which in Resolution WHA72.8 made the case for total transparency across R&D, production and supply chain costs and explicitly encouraged members to “publicly share information on the NET prices of health products”. While such a drive seems significant, the choice of key markets such as the US, Germany and the UK to dissociate themselves from such initiatives highlights the relatively limited reach of the organisation in directly influencing country decision-making.

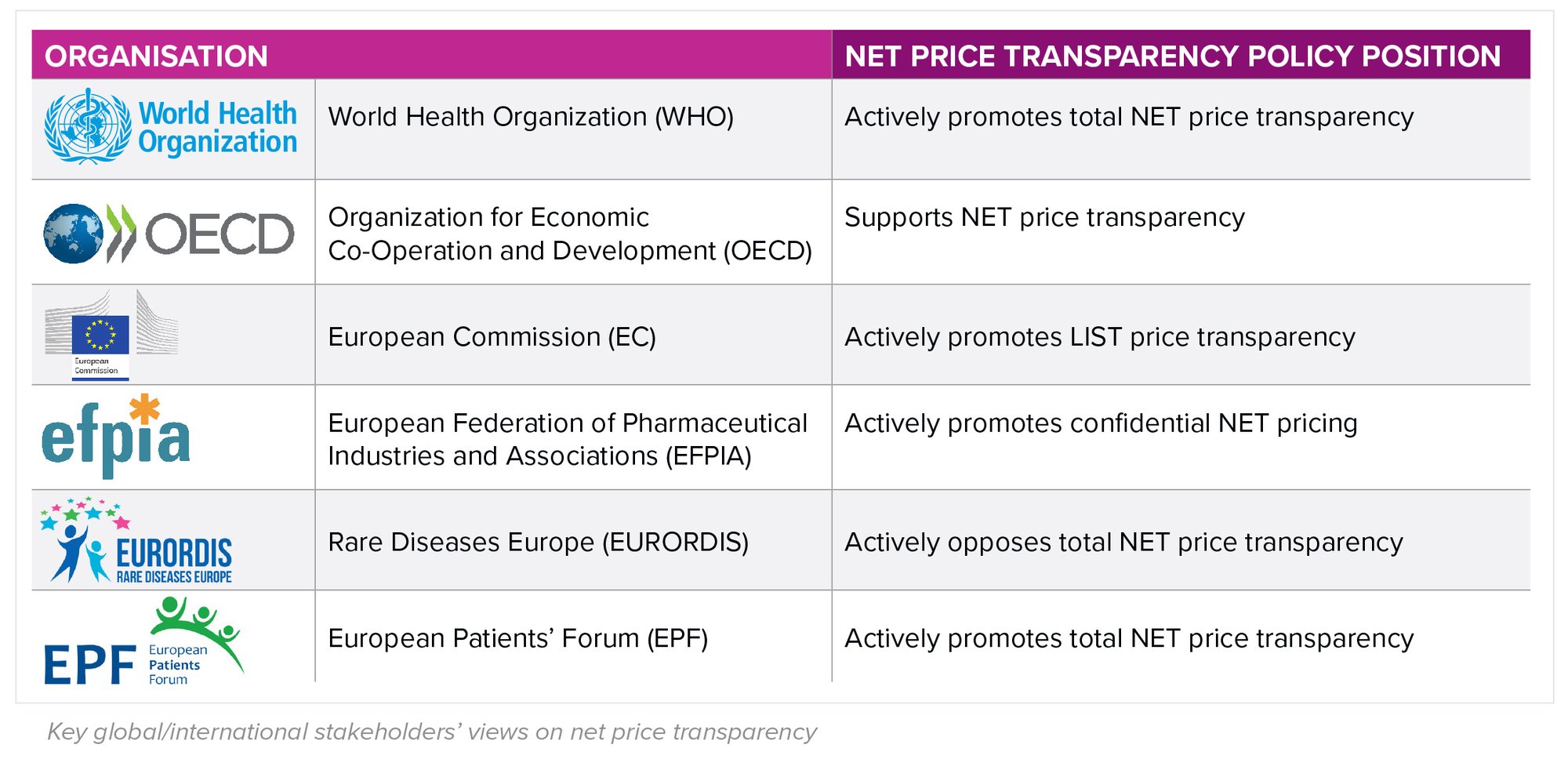

Other international organisations have differing perspectives dependent on their members’ interests, as in the table below.

How aligned are country perspectives?

Looking across key European markets, we can also see some differences in how health systems view and operationalise net price transparency. In France, Italy and the UK, net price confidentiality reigns, and at present there is limited political pressure for any of them to change their stance. In these markets, trade bodies have strong links that, alongside the regulatory and legal hurdles of switching position, will likely maintain the status quo.

In Spain, there has been more vocal opposition to net price transparency with Civio, a civil advocacy group, appealing to the Transparency and Good Governance Council (CTBG) in 2020 to permit access to net prices for 4 high-cost drugs. Indeed, in 2022, the CTBG changed its position on net price, deeming its disclosure to not be harmful to commercial interests in Spain. The results of any further reform should be watched with interest.

By contrast, at least at the national level, Germany operates a policy of transparency, with net prices freely available on the national database. However, recent legislation in the Medical Research Act (MFG) has opened the door to confidential pricing, with certain conditions on the manufacturer.

Of course, in these times of uncertain global political and economic policy, anything can change.

What does this mean for manufacturers?

Despite some opposition to net price confidentiality, in the near- and mid-term it is very likely to be the standard operating model for global pharmaceutical pricing. Manufacturers should focus on creating pricing strategies that represent the value their products offer to health systems, while using net price confidentiality as one lever to pull in negotiations. Monitoring the markets for any signals of further change is important, particularly around changes in the political landscape, and maintaining a clear and aligned position with trade bodies and other international allies will also support the cause.

We will be presenting more on the topic, including US insights at the World EPA Congress in Amsterdam on Wednesday, March 5, at 12:45 PM (CET) within the Pricing Track and would love to see you there for further discussion. And neither of us will complain if you want to buy us dinner either.